Navigating the volatile world of cryptocurrencies requires a keen understanding of market sentiment. This blog post explores some of the essential tools and techniques for analyzing the mood of the crypto market, using the cryptoQuotes-package.

The Cryptocurrency Fear and Greed Index in R

The Fear and Greed Index is a market sentiment tool that measures investor emotions, ranging from 0 (extreme fear) to 100 (extreme greed). It analyzes data like volatility, market momentum, and social media trends to indicate potential overvaluation or undervaluation of cryptocurrencies. This index helps investors identify potential buying or selling opportunities by gauging the market’s emotional extremes.

This index can be retrieved by using the cryptoQuotes::getFGIndex()-function, which returns the daily index within a specified time-frame,

## Fear and Greed Index

## from the last 14 days

tail(

FGI <- cryptoQuotes::getFGIndex(

from = Sys.Date() - 14

)

)

#> FGI

#> 2024-01-03 70

#> 2024-01-04 68

#> 2024-01-05 72

#> 2024-01-06 70

#> 2024-01-07 71

#> 2024-01-08 71The Long-Short Ratio of a Cryptocurrency Pair in R

The Long-Short Ratio is a financial metric indicating market sentiment by comparing the number of long positions (bets on price increases) against short positions (bets on price decreases) for an asset. A higher ratio signals bullish sentiment, while a lower ratio suggests bearish sentiment, guiding traders in making informed decisions.

The Long-Short Ratio can be retrieved by using the cryptoQuotes::getLSRatio()-function, which returns the ratio within a specified time-frame and granularity. Below is an example using the Daily Long-Short Ratio on Bitcoin (BTC),

## Long-Short Ratio

## from the last 14 days

tail(

LSR <- cryptoQuotes::getLSRatio(

ticker = "BTCUSDT",

interval = '1d',

from = Sys.Date() - 14

)

)

#> Long Short LSRatio

#> 2024-01-03 0.5069 0.4931 1.0280

#> 2024-01-04 0.6219 0.3781 1.6448

#> 2024-01-05 0.5401 0.4599 1.1744

#> 2024-01-06 0.5499 0.4501 1.2217

#> 2024-01-07 0.5533 0.4467 1.2386

#> 2024-01-08 0.5364 0.4636 1.1570Putting it all together

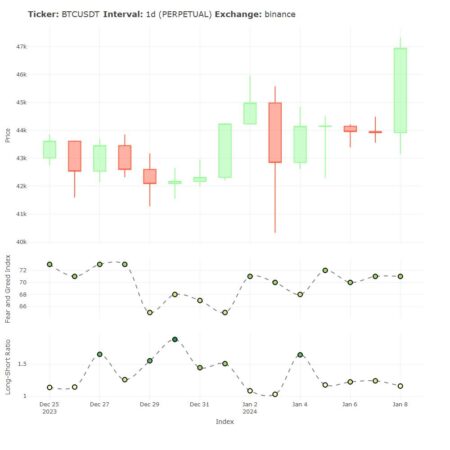

Even though cryptoQuotes::getLSRatio() is an asset-specific sentiment indicator, and cryptoQuotes::getFGIndex() is a general sentiment indicator, there is much information to be gathered by combining this information.

This information can be visualized by using the the various charting-functions in the cryptoQuotes-package,

## get the BTCUSDT

## pair from the last 14 days

BTCUSDT <- cryptoQuotes::getQuote(

ticker = "BTCUSDT",

interval = "1d",

from = Sys.Date() - 14

)## chart the BTCUSDT

## pair with sentiment indicators

cryptoQuotes::chart(

slider = FALSE,

chart = cryptoQuotes::kline(BTCUSDT) %>%

cryptoQuotes::addFGIndex(FGI = FGI) %>%

cryptoQuotes::addLSRatio(LSR = LSR)

)

Installing cryptoQuotes

Installing via CRAN

# install from CRAN

install.packages(

pkgs = 'cryptoQuotes',

dependencies = TRUE

)Installing via Github

# install from github

devtools::install_github(

repo = 'https://github.com/serkor1/cryptoQuotes/',

ref = 'main'

)Note: The latest price may vary depending on time of publication relative to the rendering time of the document. This document were rendered at 2024-01-08 23:30 CET