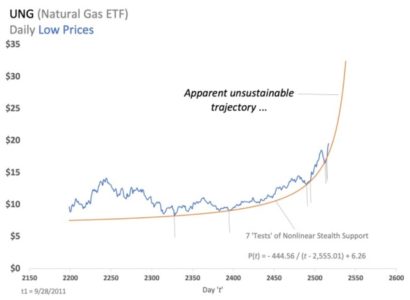

The below earlier LinkedIn post of well-defined nonlinear Stealth Support indicated price evolution for natural gas (UNG) was highly

likely on an unsustainable trajectory.

Within a month of the post, the market breached its well-defined Stealth Support Curve. In the 3 months that followed, this market lost 42% of its value.

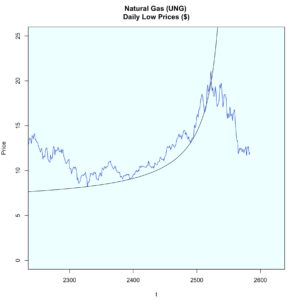

The following R code reproduces the below Stealth Curve.

UNG Stealth Curve – R Code

library(tidyverse)

library(readxl)

# Original data source - https://www.nasdaq.com/market-activity/funds-and-etfs/ung/historical

# Download reformatted data (columns/headings) from my github site and save to a local drive

# https://github.com/123blee/Stealth_Curves.io/blob/main/UNG_prices.xlsx

ung <- read_excel("... Insert your local file path here .../UNG_prices.xlsx")

ung

# Convert 'Date and Time' to 'Date' column

ung[["Date"]] <- as.Date(ung[["Date"]])

ung

bars <- nrow(ung)

# Add bar indicator as first tibble column

ung <- ung %>%

add_column(t = 1:nrow(ung), .before = "Date")

ung

# Add 40 future days to the tibble for projection of the Stealth Curve once added

future <- 40

ung <- ung %>%

add_row(t = (bars+1):(bars+future))

# Market Pivot Lows using 'Low' Prices

# Chart 'Low' UNG prices

xmin <- 2250

xmax <- bars + future

ymin <- 0

ymax <- 25

plot.new()

background <- c("azure1")

chart_title_low <- c("Natural Gas (UNG) \nDaily Low Prices ($)")

u <- par("usr")

rect(u[1], u[3], u[2], u[4], col = background)

par(ann=TRUE)

par(new=TRUE)

t <- ung[["t"]]

Price <- ung[["Low"]]

plot(x=t, y=Price, main = chart_title_low, type="l", col = "blue",

ylim = c(ymin, ymax) ,

xlim = c(xmin, xmax ) )

# Add Stealth Curve to tibble

# Stealth Support Curve parameters

a <- -444.56

b <- 6.26

c <- -2555.01

ung <- ung %>%

mutate(Stealth_Curve_Low = a/(t + c) + b)

ung

# Omit certain Stealth Support Curve values from charting

ung[["Stealth_Curve_Low"]][2550:xmax] <- NA

ung

# Add Stealth Curve to chart

lines(t, ung[["Stealth_Curve_Low"]])

Details of Stealth Curve parameterization are detailed in my ‘Stealth Curves: The Elegance of Random Markets’ text on Amazon.Brian K. Lee, MBA, PRM, CMA, CFA

Feel free to contact me on LinkedIn.